I keep wondering about some entrepreneurs living in a bubble.

Not the usual doom and gloom startup bubble or a Incubator Accelerator Bubble but a reality distorting bubble that causes them to completely forget about why people (VCs, angels, banks, others) make investments in early stage companies. They seem to read TechCrunch and think that raising capital is easy. Investors are tripping over each other to make angel and seed investments in any Tom, Dick, or Harriet that can use Keynote and string together enough words to make buzzword bingo. And, of course, with nothing more than a PowerPoint presentation and hired developer these entrepreneurs figure that they should get a $4MM pre-money valuation and be able to raise $500-$1MM, just like any of the companies coming out of YC or Techstars.

I get emails with quotes like:

“I am tour de force, the type of person people want to invest in. Driven, smart, visionary, able to build a tech team and an excellent communicator.”

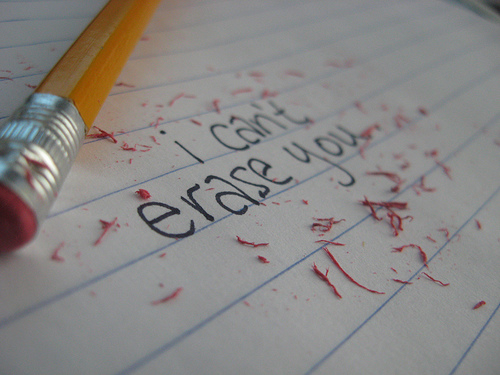

All I can say is, you need to wake up and smell the sweat. It’s time for me to be the harbinger of brutal honesty. The wrecker of unfettered dreams. The resetter of expectations.

- Ideas require execution.

- Your track record may not allow you to raise any capital without demonstrating traction.

Ideas are a Multiplier of Execution

“Same exact idea. Better execution. Big winner.” Fred Wilson.

The section is borrowed from Derek Sivers post. Ideas are part of it, but it’s execution that differentiates. It’s execution that is the massive multiplier. Stop thinking that ideas alone will differentiate. You need to demonstrate your ability to execute on the idea as a scalable business.

Execution = Demonstrate Traction

Before raising money, entrepreneurs must read The Capital Raising Ladder. This article is more than 2 years old but the key principles have not changed. Make a good guess which rung you are at? Do not pass go, do not collect $1MM on a pre of $4MM. You need to figure out where on the proverbial Ladder you fall and then figure out how to demonstrate traction. Just because you observe high tech startups and you think you can do better, this isn’t a reason that anyone should give you capital. You actually need to DO better. Go do the smallest thing to get the most bang for the buck. Call it lean. Call it customer development. Call it something. It doesn’t matter. You need to go do it.

What is traction?

It depends (go read Getting Traction). It can be revenue growth. But since many startups are too early for revenue, or are working on Dave McClure’s Startup Metrics for Pirates gives examples of consumer web applications metrics that can be measure to show growth and serve as a proxy for future revenue. Not building a consumer facing web application? Look at David Skok’s SaaS Metrics or Designing Startup Metrics to drive Successful Behaviour. It is your job to figure out how to demonstrate traction. These are starting points.

It might be as simple as demonstrating that you’re able to hire/build a team of committed developers. If you can’t convince a developer to work for sweaty equity, then you might have a hard time convincing others you are the right person to invest. If your expertise is unique and critical to the success of the venture but you can’t design the product and you can’t write code. And you can’t convince a technical cofounder or others that they should be able to work for sweat equity on the idea. Hmmm, it doesn’t lead me to think that you can convince a sophisticated (probably even an unsophisticated) investor that they should invest in you.

Start kicking butts and taking names

The goal is not to stop entrepreneurs from trying. The goal is to reset expectations about fundraising and to build world-class market changing companies. You want a $4MM pre-money valuation, go earn it! Get users! Get customers! Get big numbers on $0. What are big numbers? In true wishy washy manner, it depends. But I’ll tell you a for a startup aimed at cracking mobile for neighbourhoods in Toronto, the number of users better not be in the 100s. I’ll be impressed if the numbers are in the 10,000s, knocked over in the 100,000s and blown away in the millions. Are these number high? Are they outrageous? Maybe. But if you want a spectacular valuation, go prove to me that you deserve it.

Want to get $150,000 from Yuri Milner? Maybe you should figure out how apply to YCombinator. If you think it is so easy, prove me wrong and go do it. Maybe I’ll start a StartupNorth Fund, that all it does is bet against entrepreneurs. If you loose the bet you owe me a token amount of money, $100-500. If you win we’d invest in the next round at the negotiated price (we don’t actually have a fund to do this, but I’d be willing to stake $10-25k for matching).

Stop trying to get people to lower their expectations. Set you goals high. Figure out ways to hustle and be relentlessly resourceful, and make the metrics happen. I know we can build world-class companies (it was a busy funding week last week for Canadian startups). But we need to stop the charade that funding is flippant, easy, etc. Raising money is hard. Building a great company is hard. But it’s worth the effort. Let’s go show the world that we can build bigger, better, badder startups.