I keep seeing entrepreneurs that complain to me after the fact that they took an investment with bum terms. It comes in many different ways, usually something like, “here’s my cap table what do you think?” or “I have this term sheet what do you think of the terms?”. The terms are usually appalling. But the entrepreneurs asking don’t know this until it is too late, they signed the documents, they spent the money, and now they want advice raising the next round.

Reviewed a term sheet issued by an Ontario incubator today. Was surprised by how awful it was.

— Rob Hyndman (@rhh) June 10, 2013

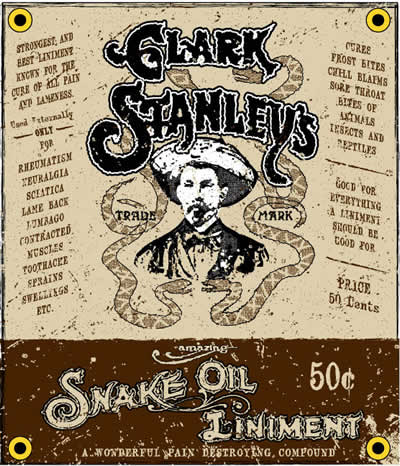

It looks like I’m not alone. If you can’t figure out this is war. This is information warfare. I forget that I work with a lot of great investors. They look for deals that work for them, their portfolio, for their investments and the potential investments. But I long ago realized that my interests and the interests of existing investors or potential investors were not always in my interest, particularly when things start to go bad. I wish all investors were as honest as Brad Feld with their desired investment rights. But there are bad investors out there. They look to use an information asymmetry to gain greater advantage over uninformed entrepreneurs. It allows them to buy large ownership percentages at reduced rates with additional rights that are not always in the favor of entrepreneurs. They tell entrepreneurs that it is ok, their capital brings additional non-dilutive government capital and the entrepreneur will have the cash to grow. They are trying to maximize their returns by exploiting the information asymmetry.

And I don’t like seeing people being exploited.

It is not the first time that someone has used both simple and sophisticated tactics to take advantage of people. Part of the creation of the Securities Exchange Commission to allow, in this case, the US government to bring civil actions ” against individuals or companies alleged to have committed accounting fraud, provided false information, or engaged in insider trading or other violations of the securities law.” Before the enactment of the commission, consumers were protected by “blue sky” laws, but Investment Bankers Association told its members as early as 1915 that they could “ignore” blue sky laws by making securities offerings across state lines through the mail. Many investors are money grubbing capitalists and that’s the way I like it. But as an entrepreneur the only person looking out for you is you. So rather than leave yourself ignorant and uninformed it is your responsibility to reduce the information asymmetry. After all, it is your company and…

Knowing is half the battle

The person that is responsible for your success and the success of your company is YOU!

So stop blaming bad investors. Stop blaming lawyers. Stop blaming others. You need to take proactive steps to reduce the information asymmetry

- Get educated

- Due diligence on your investors

- Participate and share

1. Get educated

Fifteen years ago, this information was very difficult to access. The first book that I read about venture capital was High-tech Ventures: The Guide For Entrepreneurial Success that was written in 1991. Part way in to my second venture (I was employee number 6 for the record) John Nesheim released High Tech Start Up, Revised And Updated: The Complete Handbook For Creating Successful New High Tech Companies in 2000. This was my early education about venture capital, high potential growth companies. But most of the lessons came from the school of hard knocks. But things have changed. There are a tonne of resources available to entrepreneurs. Here is a short list:

This is your business. You are taking outside funding. You need to understand what is happening in the process and why.

2. Due diligence on investors

The investor is doing diligence on you and your company. They are going to talk to your previous investors, your employees, your customers and maybe your prospects. They will take to people in their circle of trust to learn about the market, expected performance metrics, and your reputation. It is incredibly important theyunderstand the risks and accretive milestones before presenting you to their investment committee.

“I will not let my investors screw me” – Scott Edward Walker Follow @ScottEdWalker

You must do your own due diligence on the investor before taking any money. This is going to be a partner in your company. It has often been described as a work marriage. You should need/want to understand more about this person, the firm they work for, and how they treat their existing companies and CEOs. Go for dinner, have a glass of wine, talk about your company, and figure out if you can work with this person for the next few years. Talk to other CEOs that they’ve invested at a similar stage as your company. Talk to the ones that succeeded, to the ones that failed. Talk to the people that the investor sends to you to do diligence. There are so many tools to expose social relationships that didn’t exist: LinkedIn will allow you to send InMails to past CEOs; Clarity allows you to connect with a lot of entrepreneurs and mentors that have a connection with the investor; AngelList is a great tool for discovery but it is also becoming a great way to see investments and help you in your diligence.

“the diligence factor was that I knew them, but had never taken money from them. It’s hard to know how people are going to react when they are at risk of losing money because of something you are directly responsible for until you are actually at that point.” – Brandon Watson

- Due diligence should go both ways: VC check-list for entrepreneurs

- Doing due diligence on the VC – the value of speaking to portfolio CEOs

- Reverse Diligence topic on Venture Hacks

3. Participate and share

The above resources are amazing. However, I often learn best from the examples of others. I learned a lot from Mark Organ at Influitive. Mark shared stories about the good and the bad decisions he made in the early days at Eloqua. You learn a lot when you share a hotel room on the road as grown ups.

There are formal meetups like Founders & Funders. But seriously in order to have the trust, you need to get out of the office and the formalities of these events. The conversations come over a poker game. But you’ve got to put yourself out there, be vulnerable, and find people that can teach you something.

![]() Some rights reserved by slightly everything

Some rights reserved by slightly everything

I believe so much in this that I’m renovating my house. I want a big kitchen for family dinner. All of my startups will be getting an invitation to Sunday night dinner. Why? Because I’m betting my family’s future on them, and I want them to be a part of the family. This includes the ones that I’ve invested in already and any of the companies that I’m looking at investing. I want them to hang out. I want them to help each other. Share metrics and tactics. I want them to tell you that I’m slow to invest. I’m slow even after I’ve said yes (but I hope they understand that it is because sometimes I have to do some consulting work to have investment dollars). (Now I just need the renovations to finish).

Feeling screwed?

I’m starting to think about publishing shitty term sheets, depending on the risks our lawyer identifies, with investor names. I’m not sure public shaming is right model, and my lawyer might tell me it is not. But I think that we need to elevate the conversation we as entrepreneurs are having with each other and our investors.

I’ll be publishing prospective term sheets in the next few days.

Reach out if you want to share.