IOU Central, a Montreal based startup, is launching today. They have staked their claim as Canada’s first Peer to Peer lending company. We covered the funding announcement of Toronto based CommunityLend back in December.

IOU Central, a Montreal based startup, is launching today. They have staked their claim as Canada’s first Peer to Peer lending company. We covered the funding announcement of Toronto based CommunityLend back in December.

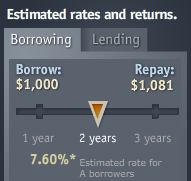

Peer-To-Peer lending has been maturing quickly as a concept on the heels of successful sites like Zopa and Prosper, but Canada has so far had no such providers. Peer to Peer lending is a concept that takes a large group of lenders who are willing to lend out smaller amounts of cash and connects them with borrowers who need access to cash at a rate that is below the standard credit card rates, but they are generally willing to pay a higher rate than if they had to go to a bank. A lender can be anyone with a bit of extra cash that they would like to get decent returns on.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.

IOU Central groups borrowers into 5 tiers: A, B, C, R, and HR. Borrowers in each tier pay IOU Central a service fee on top of the loan of 1%, 1.5%, 2%, 2.5%, and 3% respectively. Service fees varies because IOU Central expects to have to spend more to recruit lenders interested in higher risk borrowers and expect to face higher operating costs servicing loans to higher risk borrowers.

IOU Central charges Lenders a Lending Fee, which works out to about 0.5% annualized, calculated based on the amount of outstanding loans you have remaining each month.

The company was conceived over a year ago and their site has been in development for just under a year. There are currently 7 full time employees and they have raised a round of funding which includes Angels and VCs, but they did not disclose the amount of funding.

I asked Sam Bendavid, VP of Business Development for IOU Central, what sort of regulatory or legal issues they encountered running up to launch and he indicated that things were quite smooth. IOU Central is registered in Quebec as a lender and they worked closely with their law firm in developing their set of Legal Agreements.

IOU Central will be focusing most of their initial marketing on potential lenders. This is a smart move as lenders will be far more scarce than borrowers. Perhaps the days of getting a loan from Uncle Vinnie are over, and Canada now has a safe, regulated, and legal place to secure peer to peer loans.

Update: The Star provided some further coverage a few days later.

Jevon,

not sure if it will be really harder to attract lenders. In many markets p2p lending services attracted lenders faster than they could raise demand on the borrower side, resulting in rates bidded down if there is an auction mechanism.

I think they might have launched so fast since they acquired know how of the founders of a Danish p2p lending service. See my article for details on that:

http://www.wiseclerk.com/group-news/services/fairrates-iou-central-launches-p2p-lending-in-canada/

Jevon,

not sure if it will be really harder to attract lenders. In many markets p2p lending services attracted lenders faster than they could raise demand on the borrower side, resulting in rates bidded down if there is an auction mechanism.

I think they might have launched so fast since they acquired know how of the founders of a Danish p2p lending service. See my article for details on that:

http://www.wiseclerk.com/group-news/services/fairrates-iou-central-launches-p2p-lending-in-canada/

It is nice to finally see a company offering the service in Canada. I really do think that companies will do very well in this field in Canada, given Canadian’s quickness to adopt new tech, like broadband (very high adoption rates here) and things like debit cards and credit cards (again, Canadians are huge on this).

I just wish we wouldn’t be for all intents and purposes forbidden from adopting cell phone services to their fullest potential. Ah well.

It is nice to finally see a company offering the service in Canada. I really do think that companies will do very well in this field in Canada, given Canadian’s quickness to adopt new tech, like broadband (very high adoption rates here) and things like debit cards and credit cards (again, Canadians are huge on this).

I just wish we wouldn’t be for all intents and purposes forbidden from adopting cell phone services to their fullest potential. Ah well.

This may be unrelated to payday loans, but this is something that deserves attention. Washington Mutual, recently purchased by J.P. Morgan Chase in the largest bank failure in US history, disclosed $8.1 billion in debt, and $32.8 billion in assets. Once depositors started to withdraw about $16.7 billion over eight days, Washington Mutual had a ?liquidity problem.? According to Wikipedia, a ?liquidity crisis occurs when a business experiences a lack of cash that is required for day to day operations, or meet debt obligations when due.? All J.P. Morgan had to pay to acquire Washington Mutual was $1.9 billion in an FDIC auction, and put themselves in a position to decide Washington Mutual?s future, and out of the FDIC?s hands. The FDIC would have had to pay billions out to insured customers of Washington Mutual, and many think that would have drained the FDIC?s own funds down to dangerous levels. J.P. Morgan Chase has assured Washington Mutual customers that it will be business as usual. However, with more and more bank failures looming over the horizon, how long will it last for? Payday advance is a mere drop in the bucket when compared with these events.

For all my interest and excitement something like social lending, I experience not carried on able to use a social lending platform because there was not one to be had in Canada. Then, that morning, I read on NetBanker that IOU Central has launched, constructing them first out of the gate for Canadians.

For all my financial and excitement something like social lending, I have not been able to use a social lending platform as there was not one out there in Canada. Then, this morning, I read on NetBanker too IOU Central has launched, making them original out of the gate for Canadians.

At IOU Central protecting the security and privacy of lenders and borrowers and abiding by all applicable rules and regulations is of paramount importance.

hi payday your comment is good and you have denoted the wikipedia notes in it..very helpful..

jumbo loan

I know that in our home all it takes is one or two nights of insufficient sleep for a cold to show up in the morning. And recent research shows that this is not simply my imagination. A study done at Carnegie Mellon University in Pittsburgh found that getting less than seven hours of sleep a night makes http://www.chase.com you three times more likely to catch a cold. Sleeping poorly makes you five times more susceptible.Though this study was done with adults, children are similarly affected by lack of sleep. Taking steps to ensure that your child is getting enough sleep is the first way to ward off frequent infections.

Great post. Very informative and well written. Hope to see more related post from you.

This is a great news for the people of Canada. These more safe and easier to use.

Recently I visited Loanwin.com. This website claims that they are fastest growing in Canada. It was really bad experience for me. I was not able to post my loan requirement for an hour. And there was absolutely zero response to my queries. Loanwin.com is not a quality service. Please dont waste your time

nA great article indeed and a very detailed, realistic and superb analysis of the current and past scenarios.nnTerm papers