Some rights reserved by miketippett

Some rights reserved by miketippett

A great dialog recently broke out on Twitter after this tweet from Debbie Landa calling out Alberta and Quebec startups to step up and have a presence at the upcoming GROW conference in Vancouver. Having my home in Alberta I immediately put the call out to a number of the great startups currently in the province. The consensus reply I got back was ‘too busy building and getting customers!’

We all know those entrepreneurs and investors (probably the worst offenders!) who find a conference to attend every week. I often wonder how they actually build a company when they devote so much time to the conference circuit. Even in my own life I have recently been making attempts to limit the number of conferences and events I attend as they can really get in the way of work and family. However, there are some that you just can’t miss. I would definitely put GROW into that bucket, but should startups as well?

GROW is unique as it has quickly become the top startup conference in Canada and almost half of attendees are from the US. This provides a great opportunity for entrepreneurs to connect, learn and move their companies forward. So why are some startups not taking advantage of this opportunity? Probably not a single answer to this question, but I want to share a few theories.

First, lets quickly review why an entrepreneur should attend a conference:

- Customers! Obviously if there is a conference that brings together the majority of your target customers you need to be there.

- Fundraising. Don’t expect to go to a conference, meet an investor and get a check. However, it is an opportunity to gain visibility for your company, initiate relationships with potential investors (or better yet, with the entrepreneurs they have invested in) and show them why they need to follow-up.

- Recruitment. Startup conferences attract a lot of talent and it can be a great opportunity for your company to gain visibility for the purpose of recruiting.

- Partnerships. Many conferences attract execs and corp dev people from large tech companies. This provides a great opportunity to meet with them and pursue that partnership that can take your company to the next level.

- Influencers. I have already mentioned the visibility a conference can give to your company. To compound this, there will likely be many bloggers, journalists and influencers present that may write about your company after the event.

- Learnings. Technically this isn’t a real word, but I love using it. Good conferences will have thought leaders speaking that will challenge your understanding of the market, technology and building a company. These experiences can be priceless.

- Community. There is nothing quite like the energy and camaraderie that an entrepreneur can experience at a great conference. Entrepreneurship is hard, can be depressive and often lonely. Being surrounded by peers rallying around defying the odds and building a successful company is sometimes needed to push through the hard times.

- What have I missed?!?

For a more general conference like GROW that are not focused on a particular industry – compare this to Debbie’s other hugely successful conference, Under the Radar, that focuses on the enterprise and attracts many top CIOs and CMOs – it is hard to justify attending to connect with customers unless you are a consumer company. If you fall into this category then you need to attend conferences like GROW to reach the influencers that can provide social proof for your product and provide quality feedback.

So, back to the original question. Why wouldn’t a company attend GROW? If you are a seed company it may be a financial issue. Debbie pointed this out as well. If you have raised a Series A finances should not be the issue. Travel time may be though. Canada is a big place. Coming from Quebec would require two additional days to travel plus the time for the conference. This is the similar challenge New York startups face in attending conferences in the Silicon Valley.

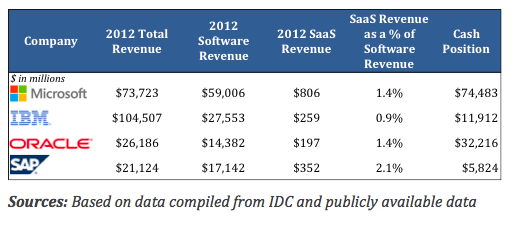

I believe a key factor in all this is the vertically-focused nature of many Canadian startups. I have long been of the belief that there are certain companies you just can’t build anywhere other than the Silicon Valley. They may start somewhere else, but need to end up there. Case in point, Pinterest, which started in Kansas City, but quickly moved to San Francisco. In Canada, it is a great place to build SaaS companies, specifically vertical SaaS companies. This includes great companies like Wave, Shopify, Clio, Hootsuite, Jobber, Top Hat, Freshbooks, TribeHR, Unbounce and the list goes on.

Lets quickly fly through my above list in the context of many of these SaaS companies:

- Customers. Very unlikely that Clio will find lawyers or Jobber find landscapers at GROW.

- Fundraising. These companies all have great investors behind them already.

- Recruitment. For local Vancouver companies this item makes a lot of sense. Tough for startups anywhere else in Canada though.

- Partnerships. Vertically-focused SaaS companies need to partner with industry specific organizations and companies (legal, accounting, transportation, etc.). Unlikely they will be attending a startup conference.

- Influencers. Unlikely that a big blog hit from Robert Scoble is going to reach SMB owners.

- Learnings. This is valuable, but not just for the CEO. My suggestion to the CEOs with companies farther along is to send someone from your management team if you can’t attend.

- Community. Definitely still a factor, but if you are a Series A company or beyond you may not be able to prioritize for this as much.

In conclusion, it appears that a vertically-focused SaaS company from outside of Vancouver would have to work harder to prioritize attending a conference like GROW. Personally, I think that there is a balance here and if these companies are going to attend at least one conference for the learnings and community it should be GROW. Or, as I mentioned above, at least send someone from your company.

Selfishly, I am a fan of what Debbie has built in GROW and it would be great to see every startup across the country there in addition to the many from the Pacific Northwest and California that attend. However, founders are faced with tough prioritization items everyday and I don’t feel it is my place to push them if they feel their time is better spent heads-down with their team building the company. What do you think the balance is?

Regardless, GROW is going to be a great event with a ton of top entrepreneurs, investors and startup people!

[Editor’s Note: This post originally appeared on Kevin’s Once A Beekeeper blog on June 30, 2013]