Before you read this, go read Mark MacLeod’s Follow @startupCFO post on Who not to take money from…. It’s not related to this post, but a great post for entrepreneurs to read when talking about investors.

If geography doesn’t matter, than why do plane tickets cost so much?

“When it comes to raising funds, I just don’t think the geography matters that much. Good solid product that solves an actual pain can find it’s way to investors any where in the world thanks to the internet.” – Adeel vanthaliwala

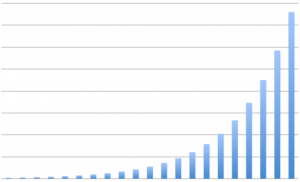

I read a lot of comments like Adeel’s. And I agree that geography might not be the most meaningful filter, it still impacts startups in raising capital. It is far easier to raise money from a broader range of sources today, than it was 10 years ago. Changes to Canadian Tax Act (Section 116) have helped open the border to outside capital. There has also been a rise of new Canadian funds that have all closed in the past 2-3 years including: OMERS Ventures, Relay Ventures, Rho Canada, BDC Venture Capital, Real Ventures, Version One Ventures, Golden Venture Partners, Tandem Expansion Fund , Georgian Partners, etc. I worry that comments don’t take into consideration the complexity and challenges of raising capital. The impact of geography on raising capital has been reduced, but geography does still affect startups raising money.

Fugetaboutit!

The best advice on geography is from Brad Feld in 2007:

- Don’t worry about it

- Be realistic about the available resources

- Find the local entrepreneurial ecosystem – now!

- Don’t try to get investors to do unnatural acts

- Don’t play the “we can be virtual” game

From the point of the investor, geography probably doesn’t matter that much. Unless of course there is a limitation in the partnership agreement that limits the geography where the capital can be invested. There are other more practical concerns about having remote startups including legal and or taxation concerns (see Section 116). Or the ability for a startup to leverage personal/professional networks for hiring, business development, etc. And none of this describes the challenges of having to spend 6 hours flying each direction to attend a board meeting. But beyond that, proximity is not a requirement from the investor side. Good startups can be located anywhere.

“Local brewers = geography matters. As macrobrew VCs are increasingly spending time in multiple geographies (separate from their HQs) there is real potential to differentiate along knowing that you can actually sit down and see your VC face to face. For some that’s important, but for some that’s a negative. Just as some people here in Boston prefer drinking Cambridge Brewing Company ale; others could care less it was brewed locally.” – David Beisel

I like David Beisel’s Follow @davidbeisel model of the VC industry starting to become more similar to the beer industry. There are larger funds, local funds, specialized funds, and individual partners. They all matter differently to entrepreneurs depending on the company, stage of development, location, etc. Understanding the available resources and your ability to access them are key.

Traction trumps geography

There is going to be the inevitable argument about companies raising money from foreign VCs. The great news is since the changes to the Tax Act and the fall of Section 116, we have a lot of examples:

- Fixmo raising from Samsung Ventures, Kleiner, etc.

- Shopify raising from Bessemer twice

- Hootsuite raising from Hearst Interactive

- Lightspeed Retail raising from Accel

- TribeHR raising from Matrix Partners

- Achievers raising from Sequoia

- GoInstant raising from a massive syndicate that includes Baseline Capital, Freestyle Ventures, Greylock and others.

- Influitive raising from an even bigger syndicate that included First Round, Lightspeed, NEA and others before $7.3 from Hummer Winblad

- Top Hat Monocle raising from Emergence and Felicis

- ShopLocket raising from Valar

- Sparkroom raising from Matrix Partners

- Upverter, Vidyard, Canopy Labs, Pair and others doing the YCombinator thing

Not to belabour the point, it is possible to raise capital from foreign investors in Canada. But the level of traction demonstrated by most of these companies was very high. For example:

“Since HootSuite’s Series A financing, we’ve grown from 200,000 users to almost 2.5 million! We’re proud of our progress and are looking forward to the future with more success on the roadmap.” – Andy Au, Hootsuite

According to my calculation that’s a 431,690% CAGR of the registered users between when they announced their Series A and Series B financing. Go big or stay home. Traction and growth trump geography. Paying customers, a scaleable business. Being able to demonstrate that for every dollar that goes into the business you understand how many (more) dollars come out. You need to be able to demonstrate appropriate milestones to mitigate risk.

Avoiding Unnatural Acts

“Don’t try to get investors to do unnatural acts: Assuming you are looking for capital, focus your energy on two categories: (1) local investors – either angel or VCs and (2) VCs that are interested in the specific business you are creating. In category #2, “software” is not a specific business – you need to be a lot more granular than that. Your chance of #2 is enhanced by a relationship / investment with someone in category #1, so make sure you focus enough energy on that early on.” – Brad Feld

The secret here is that social proof that VCs are doing deals north of the border is not enough on its own. You need to focus your efforts, and assuming that you’re doing everything you can to hit accretive milestones you still need or want to try to avoid doing unnatural things. A local investor is not required, but it can be a signalling risk about the team, market, product, or other, i.e., what am I missing if local investors are cold? (There are situations where you can imagine an entrepreneur choosing to avoid local investors, particularly if they have had a deal go sour in the past, but usually the entrepreneur discloses this very early).

What to do about location?

- Fugetaboutit!

- Start nailing concrete milestones that demonstrate traction and mitigate the risk associated with your business.

- Get connected to your local community. Look for events like Founders & Funders, Elevator Tour or GrowTalks to have initiate low risk conversations with both local investors and entrepreneurs that have raised capital.

- Do your research! Use AngelList, Google, Bing, LinkedIn, portfolio pages, etc. to find partners following and investing in companies in your very specific vertical.

- Figure out who locally is investing locally and figure out how to get a warm introduction and find 30 minutes to meet.

- Listen, ask questions, try to figure out what is missing, what is the biggest risk factor and how you might mitigate the risk.

- Rinse and repeat with non-local investors aka get your ass on a plane and keep hustlin’ (go re-read Mark Suster’s Never ask a Busy Person to Lunch).