![]() Some rights reserved by Michael Scheltgen

Some rights reserved by Michael Scheltgen

I feel like I keep having the same two conversations: either about “the lack of venture funding in Canada” or “how we build a better startup ecosystem”.

Often the conversations happen, one right after the other. The lack of venture funding is about how Canadian VCs don’t get their business because they can’t raise money. And that VCs in Silicon Valley are funding companies in the same space as theirs. Therefore Canadian VCs are conservative and because others in a similar space are getting funding in Silicon Valley/New York/Boston, they are able to raise money there too. This is proof that the ecosystem in Canada is weak. And further evidence that even with the new $400MM in funding for venture funds, that because of the conservatism in VC the ecosystem will continue to remain weaker than the ecosystems elsewhere.

<sigh type=”le” />

I am reminded of the comment that I wrote on Mark Evans blog.

“I have a weird role, because I work for a VC now, but I have always believed that it is by building better founders that we will save ourselves.

A healthy ecosystem is one where you are building successful companies. These companies make money. They have growing customer bases and revenues. Because if you aren’t building successful companies you can’t do the other things.

Successful companies are run by successful people/founders.

Successful companies hire people and put them in roles enabling them to succeed.

Successful companies need lawyers, accountants, agencies, design firms, etc.

And successful companies eventually realize they could grow faster if they didn’t have to amass the profits from operations to do bigger, bolder, crazier things that allow them to be more successful.

This is where investment comes in. The opportunity to grow more successful.

It’s not about giving money to starving entrepreneurs because we have an entrepreneur shortage. We have a successful company shortage. We have an abundance of entrepreneurs. The question is how as an entrepreneur I do the things to demonstrate I understand the risks related to building a successful company. And at different points through out my corporate development, there might be a reason to raise money to go for something bigger.

There are a ton of resources to learn what successful companies at different stages look like. Check out http://StartupNorth.ca I’ve tried along with @jevon @jonasbrandon to share my opinion, as an unsuccessful entrepeneur, what I’ve seen the successful entrepeneurs and companies do.

You need to build something that is worthy of investment. Go bigger. Go further. Demonstrate that you can build a successful company. And mitigate the risks of growth. But only when you demonstrated you know what a successful path is, should you think about raising money to grow.

The risks change at different stages of investing. It’s riskier the earlier you go, i.e., the are more risks and each risk might be unknown. But overall it’s about building a successful company.” – David Crow

Successful companies…

“If we want more entrepreneurs, how about we teach them to be, you know, entrepreneurial: self-reliant, innovative, customer-focused, not a bunch of browners trotting off to Ottawa for a pat on the head?” – Andrew Coyne, March 21, 2013 in National Post

I am still boggled at the number of entrepreneurs that tell me that “Canadian VCs just don’t get what we’re working on”. It’s your responsibility to clearly and effectively communicate why your company is successful given the current stage of corporate development. And if you think that it is easier to communicate this to foreign investors, then you should front the $600 and buy a plane ticket, and head to Boston, NYC or Silicon Valley and go through the exercise there. Raising money is hard. I think it gets harder the further away from the money you are, and the earlier in corporate development.

Being a successful company takes more than just saying “we’re the next Facebook”. You need to understand your stage of corporate development and the risks in getting your business to the next stage. Event better if you can communicate this effectively (eloquently) to people that might want to make an investment. But just saying “we’re the Facebook of <x>” doesn’t mean the company is fundable.

We have a successful company shortage

Successful companies are the scarcest resource in the ecosystem.

What’s common when we talk about one Microsoft, one Yahoo, one eBay, one Amazon, one Google, one Facebook, one Twitter is that there is “one”. It’s the prowess to build great products, great teams, great marketing, happy customers that make for lasting companies. It’s is not the opinion that makes these companies great. It’s market cap, revenues, platform penetration, customers, users, etc.

Here is a game: How many billion dollar Canadian technology companies can you name without saying RIM or Nortel?

“It is the increasingly important responsibility (of management) to create the capital that alone can finance tomorrow’s jobs. In a modern economy the main source of capital formation is business profits.” Peter F. Drucker, 1968 (from Drucker in Practice)

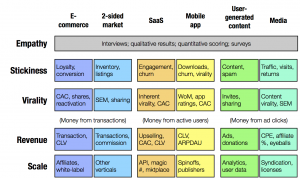

Traction, in all it’s shapes and sizes, is very hard to argue with. There are strong treatises ranging from Dave McClure’s AARRR: Pirate Metrics for Startups to Ben Yoskovitz & Alistair Croll’s recently released Lean Analytics. But it is hard to argue with companies demonstrating traction, assuming that you are knocking down the right milestones to raise a round. But this is all key to understanding, for many companies you don’t raise money because you can raise money, you raise money so you can go faster, go bigger, go further than what you would on profits alone. (Not sure what metrics you should be presenting, check out Ben & Alistair’s metrics for different types of companies at different stages of corporate development).

(Image originally published by Eric Ries on Startup Lessons Learned).

So rather than focusing on whether or not the people involved have the skills, experience or track record to be in the positions they are in. It’s better as entrepreneurs that we focus our energies on knocking it out of the park. Stop focusing on the politics of the ecosystem and start trying to demonstrate real success metrics for your company. Ultimately, it’s not a beauty contest nor is it about favouritism or cronyism or nepotism. It’s about demonstrating that you can build something successful.

You want to build a stronger ecosystem

If you want to make Toronto and Canada a stronger ecosystem, the go build something successful. Don’t worry about the pundits, the bloggers, the opinions. Worry about your existing customers, your potential customers, your market, your competitors, your employees, your bottom line, etc.

Since I already said it: You need to build something that is worthy of investment. Go bigger. Go further. Demonstrate that you can build a successful company. And mitigate the risks of growth. But only when you demonstrated you know what a successful path is, should you think about raising money to grow.