![]() Some rights reserved by Michael Scheltgen

Some rights reserved by Michael Scheltgen

I feel like I keep having the same two conversations: either about “the lack of venture funding in Canada” or “how we build a better startup ecosystem”.

Often the conversations happen, one right after the other. The lack of venture funding is about how Canadian VCs don’t get their business because they can’t raise money. And that VCs in Silicon Valley are funding companies in the same space as theirs. Therefore Canadian VCs are conservative and because others in a similar space are getting funding in Silicon Valley/New York/Boston, they are able to raise money there too. This is proof that the ecosystem in Canada is weak. And further evidence that even with the new $400MM in funding for venture funds, that because of the conservatism in VC the ecosystem will continue to remain weaker than the ecosystems elsewhere.

<sigh type=”le” />

I am reminded of the comment that I wrote on Mark Evans blog.

“I have a weird role, because I work for a VC now, but I have always believed that it is by building better founders that we will save ourselves.

A healthy ecosystem is one where you are building successful companies. These companies make money. They have growing customer bases and revenues. Because if you aren’t building successful companies you can’t do the other things.

Successful companies are run by successful people/founders.

Successful companies hire people and put them in roles enabling them to succeed.

Successful companies need lawyers, accountants, agencies, design firms, etc.

And successful companies eventually realize they could grow faster if they didn’t have to amass the profits from operations to do bigger, bolder, crazier things that allow them to be more successful.

This is where investment comes in. The opportunity to grow more successful.

It’s not about giving money to starving entrepreneurs because we have an entrepreneur shortage. We have a successful company shortage. We have an abundance of entrepreneurs. The question is how as an entrepreneur I do the things to demonstrate I understand the risks related to building a successful company. And at different points through out my corporate development, there might be a reason to raise money to go for something bigger.

There are a ton of resources to learn what successful companies at different stages look like. Check out http://StartupNorth.ca I’ve tried along with @jevon @jonasbrandon to share my opinion, as an unsuccessful entrepeneur, what I’ve seen the successful entrepeneurs and companies do.

You need to build something that is worthy of investment. Go bigger. Go further. Demonstrate that you can build a successful company. And mitigate the risks of growth. But only when you demonstrated you know what a successful path is, should you think about raising money to grow.

The risks change at different stages of investing. It’s riskier the earlier you go, i.e., the are more risks and each risk might be unknown. But overall it’s about building a successful company.” – David Crow

Successful companies…

“If we want more entrepreneurs, how about we teach them to be, you know, entrepreneurial: self-reliant, innovative, customer-focused, not a bunch of browners trotting off to Ottawa for a pat on the head?” – Andrew Coyne, March 21, 2013 in National Post

I am still boggled at the number of entrepreneurs that tell me that “Canadian VCs just don’t get what we’re working on”. It’s your responsibility to clearly and effectively communicate why your company is successful given the current stage of corporate development. And if you think that it is easier to communicate this to foreign investors, then you should front the $600 and buy a plane ticket, and head to Boston, NYC or Silicon Valley and go through the exercise there. Raising money is hard. I think it gets harder the further away from the money you are, and the earlier in corporate development.

Being a successful company takes more than just saying “we’re the next Facebook”. You need to understand your stage of corporate development and the risks in getting your business to the next stage. Event better if you can communicate this effectively (eloquently) to people that might want to make an investment. But just saying “we’re the Facebook of <x>” doesn’t mean the company is fundable.

We have a successful company shortage

Successful companies are the scarcest resource in the ecosystem.

What’s common when we talk about one Microsoft, one Yahoo, one eBay, one Amazon, one Google, one Facebook, one Twitter is that there is “one”. It’s the prowess to build great products, great teams, great marketing, happy customers that make for lasting companies. It’s is not the opinion that makes these companies great. It’s market cap, revenues, platform penetration, customers, users, etc.

Here is a game: How many billion dollar Canadian technology companies can you name without saying RIM or Nortel?

“It is the increasingly important responsibility (of management) to create the capital that alone can finance tomorrow’s jobs. In a modern economy the main source of capital formation is business profits.” Peter F. Drucker, 1968 (from Drucker in Practice)

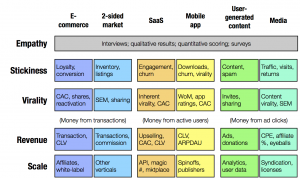

Traction, in all it’s shapes and sizes, is very hard to argue with. There are strong treatises ranging from Dave McClure’s AARRR: Pirate Metrics for Startups to Ben Yoskovitz & Alistair Croll’s recently released Lean Analytics. But it is hard to argue with companies demonstrating traction, assuming that you are knocking down the right milestones to raise a round. But this is all key to understanding, for many companies you don’t raise money because you can raise money, you raise money so you can go faster, go bigger, go further than what you would on profits alone. (Not sure what metrics you should be presenting, check out Ben & Alistair’s metrics for different types of companies at different stages of corporate development).

(Image originally published by Eric Ries on Startup Lessons Learned).

So rather than focusing on whether or not the people involved have the skills, experience or track record to be in the positions they are in. It’s better as entrepreneurs that we focus our energies on knocking it out of the park. Stop focusing on the politics of the ecosystem and start trying to demonstrate real success metrics for your company. Ultimately, it’s not a beauty contest nor is it about favouritism or cronyism or nepotism. It’s about demonstrating that you can build something successful.

You want to build a stronger ecosystem

If you want to make Toronto and Canada a stronger ecosystem, the go build something successful. Don’t worry about the pundits, the bloggers, the opinions. Worry about your existing customers, your potential customers, your market, your competitors, your employees, your bottom line, etc.

Since I already said it: You need to build something that is worthy of investment. Go bigger. Go further. Demonstrate that you can build a successful company. And mitigate the risks of growth. But only when you demonstrated you know what a successful path is, should you think about raising money to grow.

Nice one David. BIG exits solve all and we ALL from both sides of the table need to step up our game on this front. I keep saying that we have the raw material in the form of a couple dozen companies or so who could have that big exit. In ten years of being a VC I’ve never seen this potential. Ultimately our goal needs to be nine figure plus exits with serious frequency, meaning we see them multiple times a quarter. But we start with a few and the momentum scales from there. Doing my best to support the entrepreneurs I’m partnered with to ensure they have the cash and resources to go long!

I feel like there is a growing number of entrepreneurs that understand what a great company looks like but there are also a growing number of hipster startup founders in orange skinny jeans pulling off the stage show pitch. They are media friendly but can’t raise real money… that causes a PR problem as the wrong story is being told.

Fortunately, the stories are getting told. It’s important that there is local media coverage of founders, companies, etc. Even if they are the wrong people.

The scale that media can bring to a startup in awareness is impressive. We do need to teach Canadian startups that launch is a shitty story. They need to learn about media cycles and tell better stories.

Amen, bro.

I couldn’t agree more, especially with your last point above. I’ve been advising companies to pay close attention to news cycles and look for opportunities to attach their stories to what’s going on in the wider world, where real people (ie. customers) live. As much as building a company demands heads-down focus, it also demands heads-up awareness of what’s happening in the world; that’s how to identify the problems that need solving.

but government sponsored surveys and assessments about how we’re doing today, what challenges we’re facing, how we’re collaborating and succeeding are still important right??

agreed and while it’s pitching my own bits, along with StartupNorth, we’re doing our best to have http://threeFortyNine.com be an authentic voice attempting to share some of those real stories. If anything, we’re likely too focused on the ugly, dirty stories but I’m ok with that. If some dirty stories discourage you from making your leap then it ain’t for you. Our focus must always return to the company, to the project and it’s needs.

(ps no idea if links here are cool or should be avoided…)

Isn’t the scarcity of billion dollar companies also a result of founders cashing out way too early? If all it takes is a few million to make a founder give up their business then they mustn’t have believed their own “We’re the next Facebook” claims.

Maybe that’s the typical Canadian conservatism at work. Even if you believe you have a billion dollar idea, after the brutal struggle just to get it launched a few million dollars and the sweet embrace of financial security is just too tempting. Particularly (I think) for technical founders who are probably already looking for the next challenge.

David – Great post – So, so true. Blaming the lack of capital, or any other outside of the company event only makes one a victim of circumstance. Great entrepreneurs decide that no one, and nothing stands in their way of their success, and because of that self imposed pressure to find the answers….they find them.

I can’t blame folks for taking money off the table. Maybe that’s conservatism, it’s probably practically.

I think early exits are part of a healthy ecosystem. We have companies that grow large. Those that get taken out. Those that operate profitably.

We can’t use the “cashing out way too early” as any excuse for the lack of big exits. We need a deeper bench.

Awesome stuff David. All I can say is, I left a crazy awesome gig at Canada’s most active seed VC fund in large part so I could join and help build a successful company – FreshBooks. I often tell entrepreneurs – the single best thing you can do for the ecosystem is build a great company. That’s all I’m focused on now.

Excellent. Well said. I have found the Canadian startup ecosystem to be nothing but supportive and inspirational. Happy to be a part of it.

I can’t help but wonder if the fact that it’s the same 50 people always talking about these topics isn’t part of it too. We are becoming our own tiny whiny echo chamber.

Echochochochochochochooooooooooo…..

If a tree falls in a forest and only 50 people are talking about the tree does it really matter?

50 was the exact number that 2-3 others have mentioned to me in conversation. i keep rounding it up to 250 (yes 5x) but it’s a really small number of people.

Well said. We’ve come a long ways in the past couple of years especially, and these 2 issues you mentioned are no longer significant issues.

Now is the time to scale-up and claim a larger success footprint.

Right. Even if we go with 250, I mean geeeeeeeeeez.

That’s a good cheerleading post, but I assume most entrepreneurs are already working hard to succeed.

The fact is that Canadian VCs have always lagged their American counterparts. The top American firms have advantages that cannot be matched by their peers in either the U.S. or Canada. We should face reality—this has always been true. The best American firms can promote, control news coverage, recruit, finance, secure exits and execute IPOs at a level that is far above any Canadian peer.

Add to that the traditional bias of most Canadian VCs to conservatism, the limited connections and industry “pull” at most VC shops, and the tendency of Canadian VCs to grab at early exits, and you have a recipe for poor performance. The distortions caused by government money and, until recently, the labour-sponsored funds, only made things worse.

We live in a global world, and not every location is equally blessed for every industry. Canada is a wonderful place to finance a mining or oil business, but in technology and media California and New York still rule. And always will.

Most startups should concentrate on making money as fast as possible. Chasing VC is a long-shot approach and a distraction. There are very few firms in Canada and the odds of getting an early deal are slim at best. No businessperson should bank on long-shots. And generally if a startup is succeeding then VCs will come calling anyway.

And absolutely all Canadian startups should be fundraising in America. It’s crazy to limit the search to Canada. American VCs fund more and will give higher valuations. And there are plenty of American VCs! So definitely American firms should be on the pitch-list for all Canadian entrepreneurs. Ultimately you’re selling product or stock, and in a global economy, it’s absurd to limit sales to Canadian customers.

David, your argument seems circular. You say that the “ecosystem” will grow if there are more large successes—but what is the point of the ecosystem if not to produce them? Effectively you seem to be saying “make some big successes so that we have some big successes”. Do I understand you correctly?

Canadian entrepreneurs should not limit their search for capital to Canadian VCs. That’s crazy. American firms should be sought out and pitched aggressively. Cash is a commodity. Canadian VCs have to show the value they bring to a global technology game. They have to compete.

It’s also important to remember that all VCs are not equal. A good VC can be a tremendous ally to a company. A bad VC will get you killed.

My argument is that you can’t make an personal decision based on the perceived needs of a mythical ecosystem. Entrepreneurs that take money off the table, you can’t blame them, they are doing what is best for their families/themselves/etc.

Entrepreneurs should stop worrying about the ecosystem and aim to build massively successful companies. A string ecosystem is the by product of successful companies.

Agreed. The “ecosystem” is for governments to worry about, not entrepreneurs. Entrepreneurs should focus on their customers. Happily, most do.

Shocking! Someone actually talks some sense to students about startups –

David Heinemeier Hansson (37 Signals / Ruby on Rails) at Stanford (‘Unlearn Your MBA’) – http://ecorner.stanford.edu/authorMaterialInfo.html?mid=2351